The Agentic Finance Landscape in 2025

Written in collaboration with contributors Lincoln Murr (Coinbase), Stefano Bury (Virtuals), Rishin Sharma (Solana), Pilar Rodriguez (The Graph), David Mehi (Google Cloud), and Cambrian teammates Ariel, Brian, Doug, Jason, Ricky and Tumay.

The agentic finance revolution is gaining critical mass, and there’s massive economic upside on the table for people who amplify their financial activities using agents. AI agents are autonomous tools that can analyze data, make decisions, and execute trades, with varying degrees of human input. Agents are available to the masses, and they're emerging to disrupt finance, a field long dominated by Wall Street and its high-octane algorithms.

This blog post surveys the agentic finance landscape from the perspective of autonomous tools that help retail participants in decentralized finance (DeFi). Our team and contributors spent months researching and interviewing dozens of projects across the industry. The result is a hyper-curated list of active projects adhering to a high bar for excellence and legitimacy. We categorize financial agents by product type and identify existing products for each category.

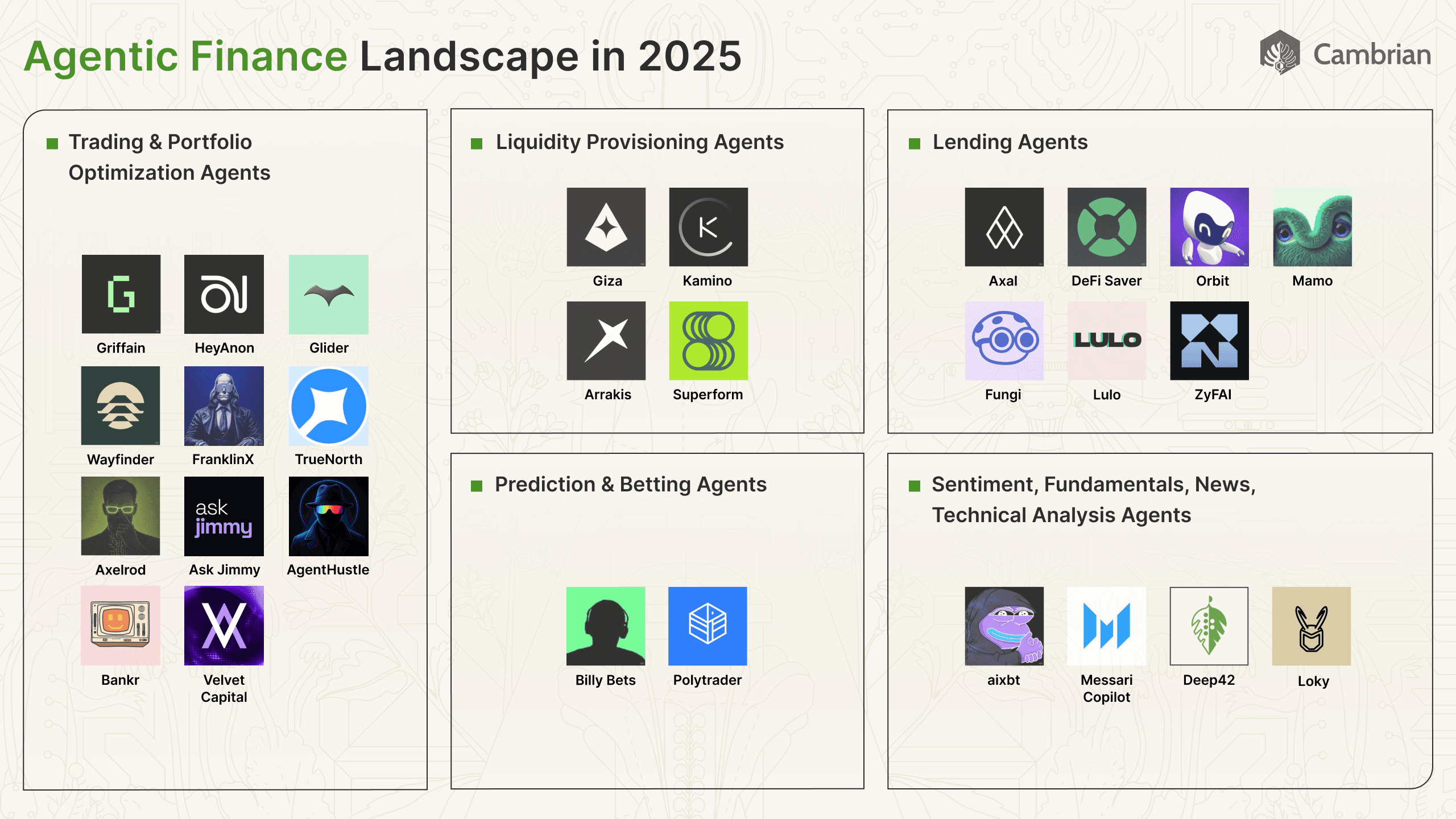

Agentic finance will help mature the crypto industry by surfacing up-to-date information, providing professional guidance, and offering a better user experience to everyday people. Here’s a categorized quick-glance view of the landscape:

Jump down to learn more about each depicted project.

Table of Contents

- What is Agentic Finance (AgentFi)?

- Autonomy vs. Intelligence in Agentic Finance

- The Agentic Finance Landscape in 2025

- What’s next for Agentic Finance?

What is Agentic Finance (AgentFi)?

Agentic finance refers to the emerging market segment with products using AI or machine learning to actively manage user funds or provide financial advice. Inspired by ChatGPT and similar AI tools, some of these products utilize LLMs, while others employ hard-coded rules or traditional machine learning. Regardless of the underlying tech, many of them describe themselves as “agentic.”

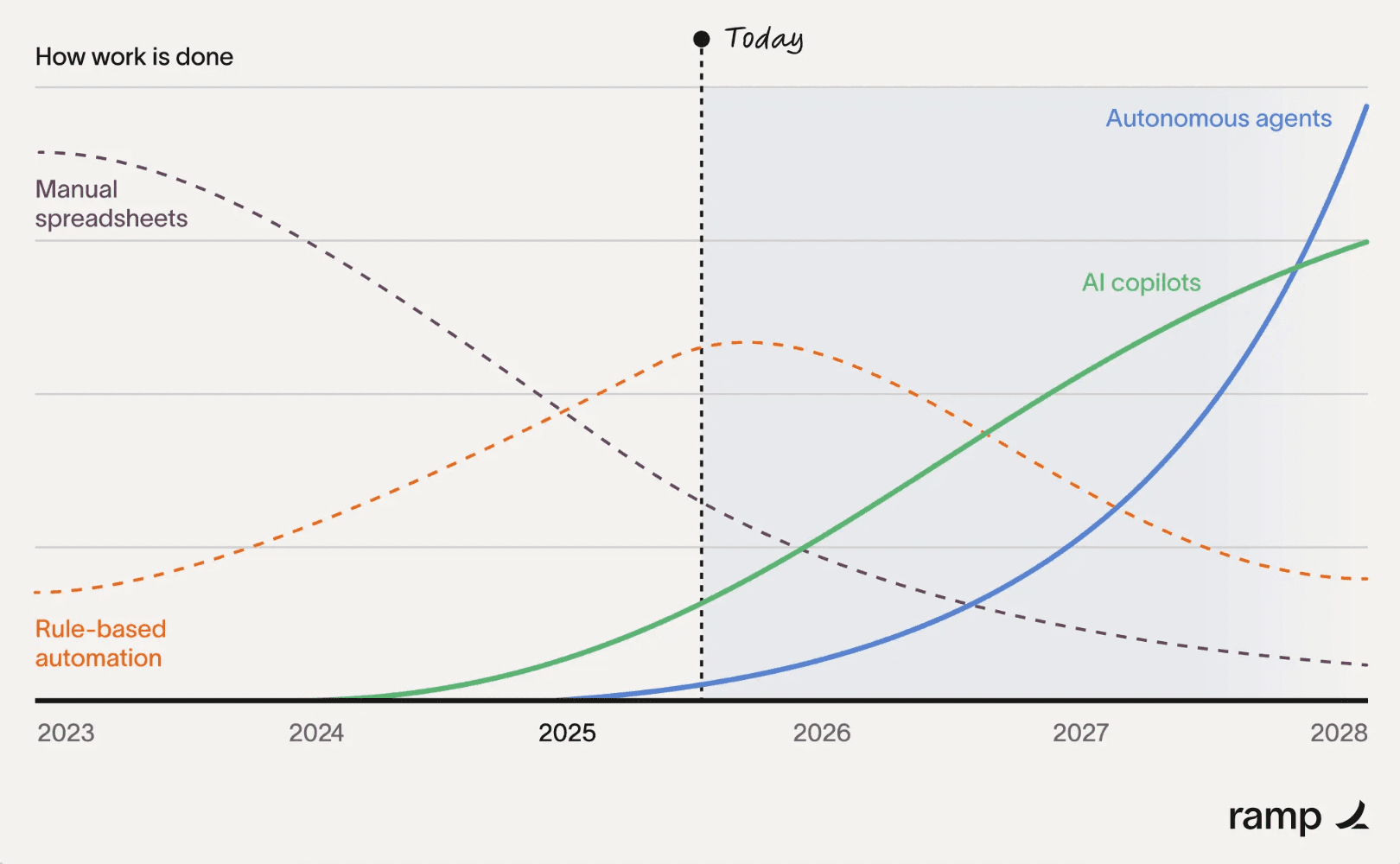

Today, we’re at an inflection point. Agentic finance is at the “innovators” phase of the adoption cycle. Soon, agents and AI copilots will dominate financial activity. Source: Ramp

In the very near future, traders, portfolio managers, financial analysts, research analysts, and all other financial professionals will utilize specialized agentic finance products to accelerate their work, and similar autonomous versions will be made available to consumers. This is already starting to happen. For example, trading bots account for over half the trades on Solana today¹.

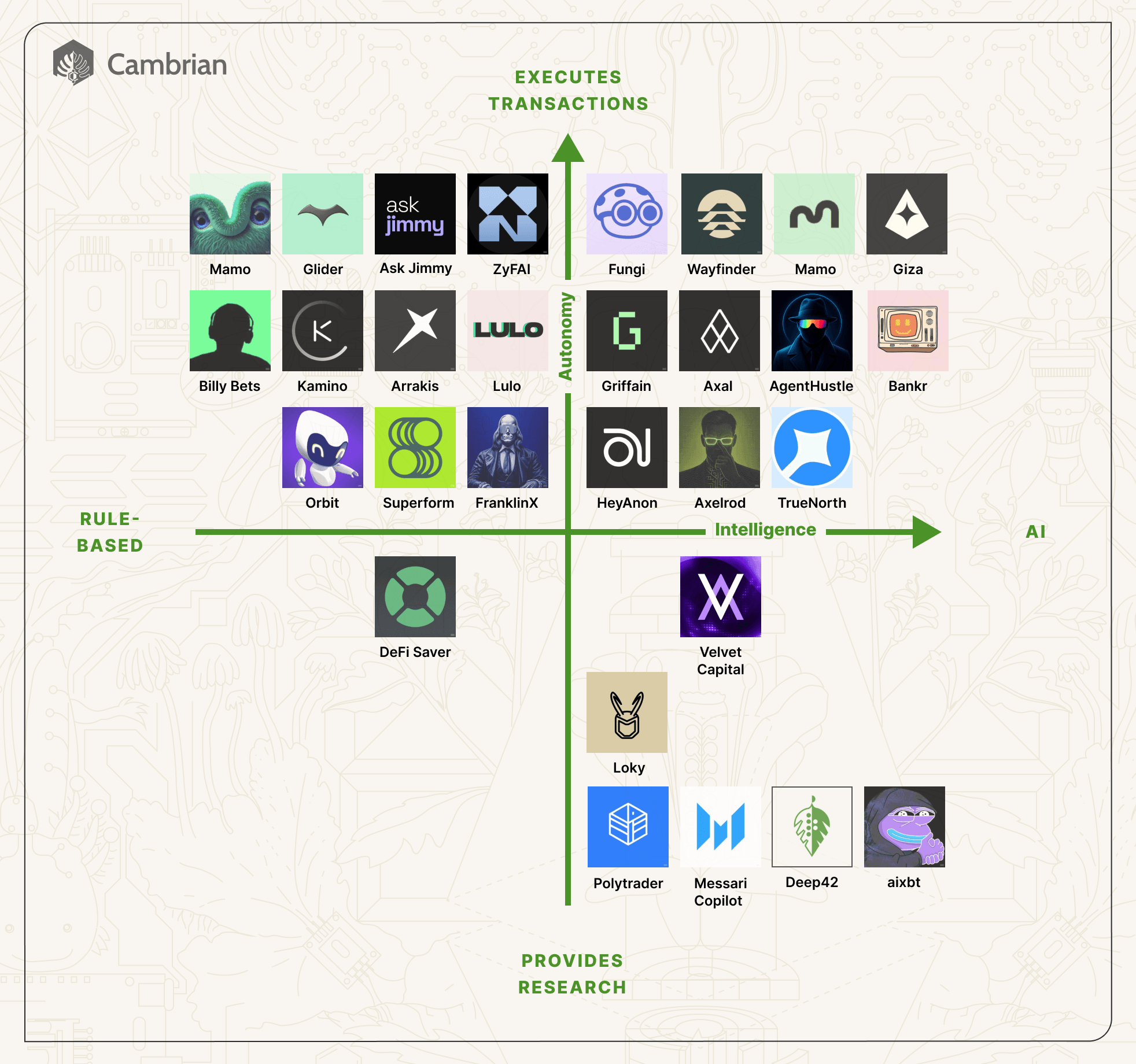

Autonomy vs. Intelligence in Agentic Finance

Agentic finance projects are designed for different, specialized use cases - more on that soon. Each of them falls into a range of what I call the Autonomy-Intelligence Compass. In the plot above, the level of the agent’s intelligence is on the x-axis. On the left side, we find rule-based agents, using math or statistics for their brains. Agents on the right side utilize AI tools like LLMs (or whatever replaces LLMs in the future). Machine learning intelligence sits in the middle of the x-axis. The y-axis represents autonomy. Agents on the bottom are restricted to providing advice or analysis. Agents at the top make decisions and execute transactions without permission. Human-in-the-loop autonomy sits in the middle.

When you hear “agentic finance,” you may think of state-of-the-art LLMs or invisible robots managing portfolios, attempting to generate profits by trading automatically. However, systems like that haven’t been widely deployed yet - there’s still too much risk to use unstable LLMs for that. For example, LLMs still frequently hallucinate “facts” and only recently gained the ability to count the number of r’s in strawberry. Today, most agents might use an LLM for the user interface or for analysis, and they excel at those tasks, but for managing money money they’ll use simple, well-known math or machine learning. These are techniques that TradFi has used for decades.

The fact that LLMs struggle with math makes sense from a historical perspective, because they were originally designed to complete sentences. But that’s already changing. As AI continues to rapidly improve, we expect new autonomous LLM-based products to emerge or existing products to evolve. For example, Anthropic now offers a financial product used by major institutions, and OpenAI recently trained an LLM that is competitive in the International Mathematical Olympiad.

The Agentic Finance Landscape in 2025

Below, I focus on projects that have already deployed agents managing money or made them available for use by consumers. Projects still in the development or internal testing phases aren’t listed. And projects that only use an LLM interface, but require humans to make the “hard” decisions aren’t listed. This ruled out many projects.

Trading and Portfolio Optimization Agents

Trading agents are the first product most people think of when they hear “agentic finance.” These agents manage users' funds by rebalancing portfolios or picking assets to buy or sell. Decision-making in trading requires access to an exchange, assets to trade, a budget, trading guidelines or rules, and high-quality data. The agentic tools below provide support for one or more of these.

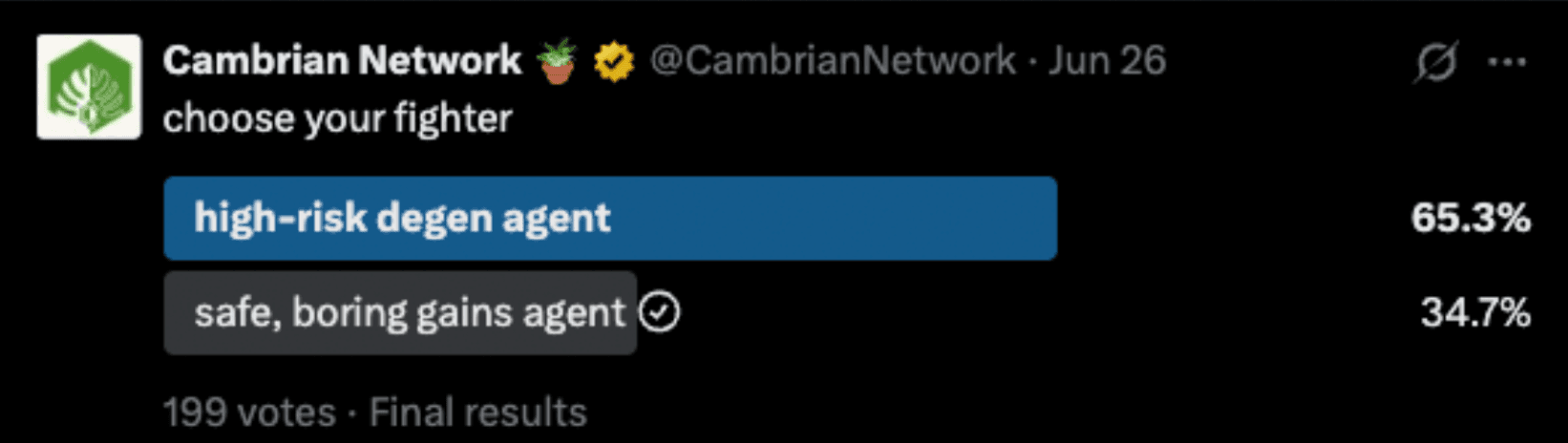

The results of Cambrian’s recent X poll show that most followers are excited about high-risk trading agents.

Liquidity Provisioning Agents

Decentralized exchanges (DEXes) rely on third-party liquidity providers (LPs) to provide liquidity in the form of tokens that traders can access. Traders pay fees when buying or selling tokens in a DEX. Those fees go to the LPs. Several factors determine LP profitability, including impermanent loss, volume, and incentives from DEX protocols. The following agent projects help LPs identify where they can earn the most fees by providing liquidity.

Lending Agents

Lending in crypto is a way to earn yield by supplying crypto assets to borrowers who pay interest. When deciding whether and when to deposit crypto into a lending protocol, lending agents must consider a combination of yield, risk, and opportunity cost factors.

Prediction and Betting Agents

Prediction markets are platforms where users can bet on the outcomes of future events, such as election results or sports competitions. These markets often require tracking news or other real-world information that can unfold and change in unexpected ways in real-time. Prediction markets are an ideal fit for agentic participants, as outlined in this blog post by Vitalik Buterin on information finance (InfoFi).

Sentiment, Fundamentals, News, Technical Analysis Agents

Investors often use market analysis to determine what to buy and sentiment analysis to decide when to buy or sell. LLMs have significantly transformed both market and sentiment analysis by scaling the amount of data analyzed, the speed at which it is analyzed, and creating a deeper contextual understanding by identifying connections between data sources. A distinguishing feature between analysis agents and the agents above is that these agents do not take direct actions - they are informative. There are many analysis agents; we only list a few below.

It should be noted that the agentic finance landscape is evolving rapidly and that existing projects are expanding into new domains. For example, even if a project is only listed in the lending category today, we could expect them to branch into liquidity provisioning tomorrow.

Promising Early-Stage Agents

We’ve made an effort to highlight agents that are publicly available and well-maintained. There are some promising projects that we expect to see meet that criteria, but their agents are still in early stages. It’s worth keeping an eye on the following:

What’s next for agentic finance?

Financial assets are continuing to move onchain by the billions. Also, consider onchain stablecoin transaction volume is at an all-time high, and traditional fintech players are embracing onchain financial rails. For example, Robinhood recently launched the tokenization of U.S. stocks to provide 24/7 onchain trading access to global investors. It’s thrilling that the crypto industry will expand its use cases beyond speculative trading to include investment use cases. However, anyone who’s been active in crypto knows that successfully participating in decentralized finance is not easy. But DeFi’s barriers to entry are about to crumble, and many blockchain developers believe agentic products are the key to making DeFi both usable and profitable.

Agentic finance is an emerging market segment. Many of the tools listed above are the first of their kind in both traditional finance and decentralized finance. We expect some of these early tools to fail to deliver on their promise, but we’re confident that the agentic finance landscape will continue to mature. Eventually, everyone will use agents, and those who begin their agentic finance journey now will reap the rewards in the future. Additionally, as developers earn trust from users through consistent returns, users will care less about agents’ strategies, which we expect to become increasingly complex, for example, by blending both trading and liquidity-providing management.

There are related topics that we may cover in future posts, including agent-to-agent (A2A) communication and payments, agent infrastructure and frameworks, data infrastructure and indexers, onchain identity, agent launchpads and marketplaces, privacy and verifiability, and modeling and simulation. To stay ahead of the agentic finance curve:

- Sign up for the Cambrian newsletter to be notified of our next post.

- If you’re a developer building agentic applications, register for the Cambrian API limited-access advanced release cohort.

Lastly, connect with me on X to share your ideas or to let me know if I’ve missed anything in the first edition of the agentic finance landscape.

About the author

Sam Green is the founder of Cambrian Network, the financial intelligence layer for agents. Prior to Cambrian, Sam contributed to Semiotic Labs as co-founder and CTO, leading AI and verifiability efforts for The Graph. Sam also helped develop Odos, a leading crypto trading platform that has handled $100 billion in trading volume for 3 million users. Previously, Sam was an AI and cryptography researcher at Sandia National Labs. Sam holds a master's degree in applied mathematics and earned a Ph.D. in computer science at UC Santa Barbara.

About Cambrian

Cambrian is the financial intelligence layer for agents. Cambrian’s API provides real-time and historical blockchain data for agentic DeFi applications. We're focused on providing verifiable financial insights, including yield, liquidity positions, risk, whale activity, market sentiment, and standard DeFi data.

This content is for general information only and does not constitute financial, investment, legal, or tax advice. Accuracy is believed reliable at the time of publication but is not guaranteed, and opinions may change without notice. You should conduct your own research and consult qualified professionals before making decisions. References to third‑party projects do not imply endorsement. The author and publisher accept no liability for any loss or damage arising from reliance on this material.

Sources:

¹ https://www.helius.dev/blog/solana-ecosystem-report-h1-2025